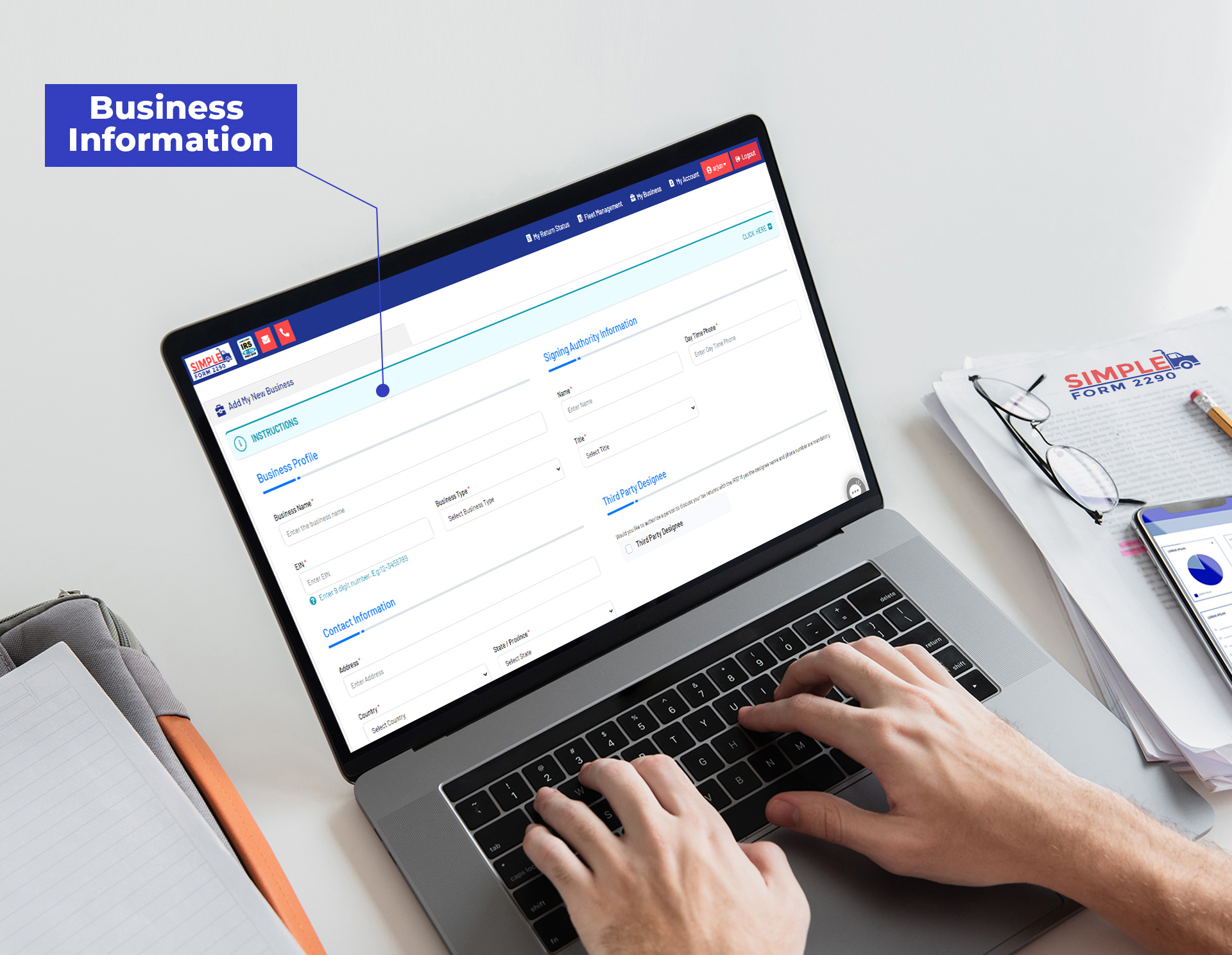

Business Details :

- Business Name

- Employer Identification Number (EIN)

- Address

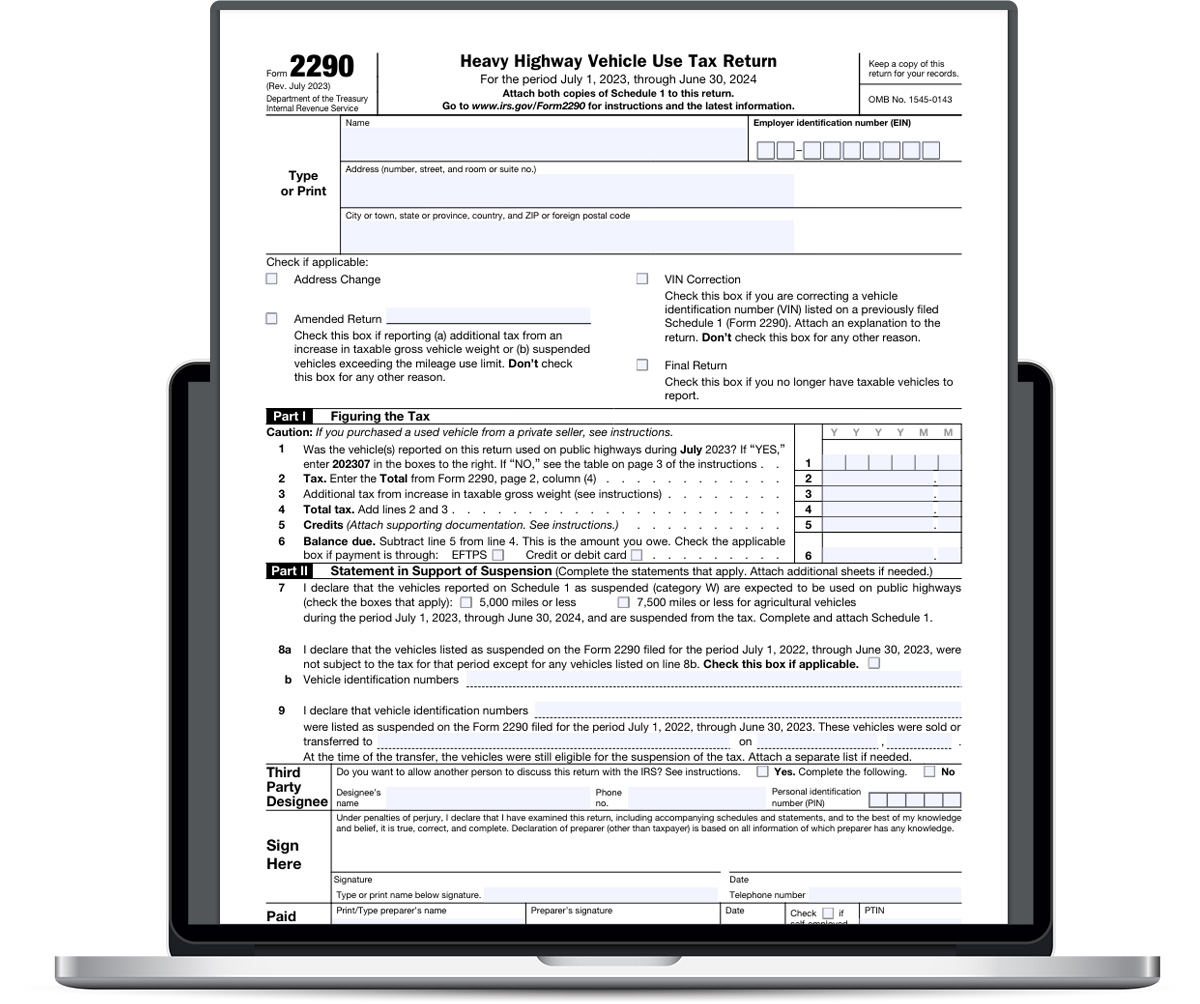

Vehicle Details:

- Taxable Gross Weight Category

- Vehicle Identification Number (VIN)

- First Used Month of the Vehicle

- Suspended Vehicle (if any)

Before you receive a stamped Schedule 1, you must file your Form 2290 and pay the HVUT. With Simple Form 2290, filing the form 2290 and receiving Schedule 1 is quick and simple.

After submitting Form 2290 via Simple Form 2290, you will get Schedule 1 via email in just a couple of minutes.

So, instead of filing with pen and paper, which takes longer to complete your Form 2290 filing, move online through our Simple Form 2290 tool.